Element 4.11: Reduce Your Risks

“Look Before You Leap”

Many reading this book will soon be making important decisions regarding what to do after completing school. Should you go to university, acquire vocational training, or enter the labor force immediately? If you go to university, which one will you choose? Should you select a three-year or four-year, private or public, local language or foreign language program, local or abroad university? How will you choose a major? Which university provides you with the most attractive options? These are important investment choices, and a significant amount of money and hours of potential emotional satisfaction are at stake. Thus, it is crucially important that your educational choices are well-informed. As you make educational choices, here are some important factors to consider.

While university may be a desirable option, it is not for everyone. Going to university is costly. If a student incurs the time and money cost of going to university for a couple of years, then drops out without a diploma, the investment is unlikely to be an attractive one. The biggest risk for a student considering postsecondary education is the possibility of a negative return on his or her investment. This would occur if the higher earnings achieved from that education are less than the costs involved in obtaining the education.

According to the OECD higher educational attainment significantly increases the likelihood of earning above the median income, as shown in Exhibit 30. Among individuals with below upper secondary education, only 26 percent earn above the median, whereas among those with a Master's, doctoral, or equivalent degree, 77 percent earn above the median.

Source: stats.oecd.org.

In general, the median annual earnings for workers holding bachelor’s degrees is higher than for those who only have a school diploma, This holds true for just about every country in the world. (If you can find an exception, let us know and we will cite you on our webpage!) But there is substantial variation in the earnings of university graduates. The actual earnings after graduation depend on many factors, including the skills acquired, major, and the overall demand and supply conditions of a particular labor market. In early 2024 The Federal Reserve Bank of New York published a study of mid-career earnings of college graduates with 75 different majors. The top 10 best paid are:

- Chemical Engineering

- Computer Engineering

- Aerospace Engineering

- Electrical Engineering

- Computer Science

- Mechanical Engineering

- Civil Engineering

- Industrial Engineering

- Economics

- Construction Services(157)

Can anyone see the pattern here? As a hint – it becomes even more striking when you know that “Construction Services” includes “Structural Engineering.” Please know that we are not saying you should not study History, Latin, Sociology or Drama, if that is what will make you happy. Just be aware that there will be an opportunity cost in lower earnings. Just be sure you love the field enough to make the financial sacrifice. Also, be aware that if you borrow to pay for your education, you will be paying back out of lower earnings.

Let’s consider why students sometimes choose educational options that result in negative returns. First, many students have unrealistic expectations about future earnings accompanying career choices. With inflated expectations, they may be willing to pay more for their education than what their future earnings can support. You should investigate resources to keep informed of current and predicted future labor market conditions and earnings potential. You need to search for the handbooks or statistics for your country and those to which you might possibly migrate. These will provide information on main occupations, including their requirements, job outlook and growth prospects, and median pay. Many contain projections of future demand. (It is easy, for example, to know that if there is a drop in the birth rate there may not be many new school teachers needed in the next few years.) Having realistic expectations about future income is a vital ingredient in making better decisions about postsecondary education. In the context of possible migration, it is also important to start at an early age learning useful languages. Do you want your options to include English-speaking countries or French-speaking ones?

Second, many students underestimate the cost of education. The total cost of education includes the direct cost of tuition, books, fees, and room and board. But don’t forget about opportunity costs. Going to school, even part-time, means giving up current income from a job. Make sure to properly account for the total cost of education.

Third, students overuse debt. Some view the student loan check as free money and borrow too much. Many young people are ill-prepared to judge how difficult it will be to squeeze the funds for repayment of student loans out of their monthly budget after graduation. Assuming a 3 percent interest rate, you will pay €345 per month for fifteen years to repay $50,000 in loans. You will pay €518 per month for fifteen years to repay €75,000, and €691 every month to repay €100,000. Will your future earnings be sufficient to make the monthly payment on your student loans within the context of your overall budget? Think seriously about this issue prior to taking out a student loan.

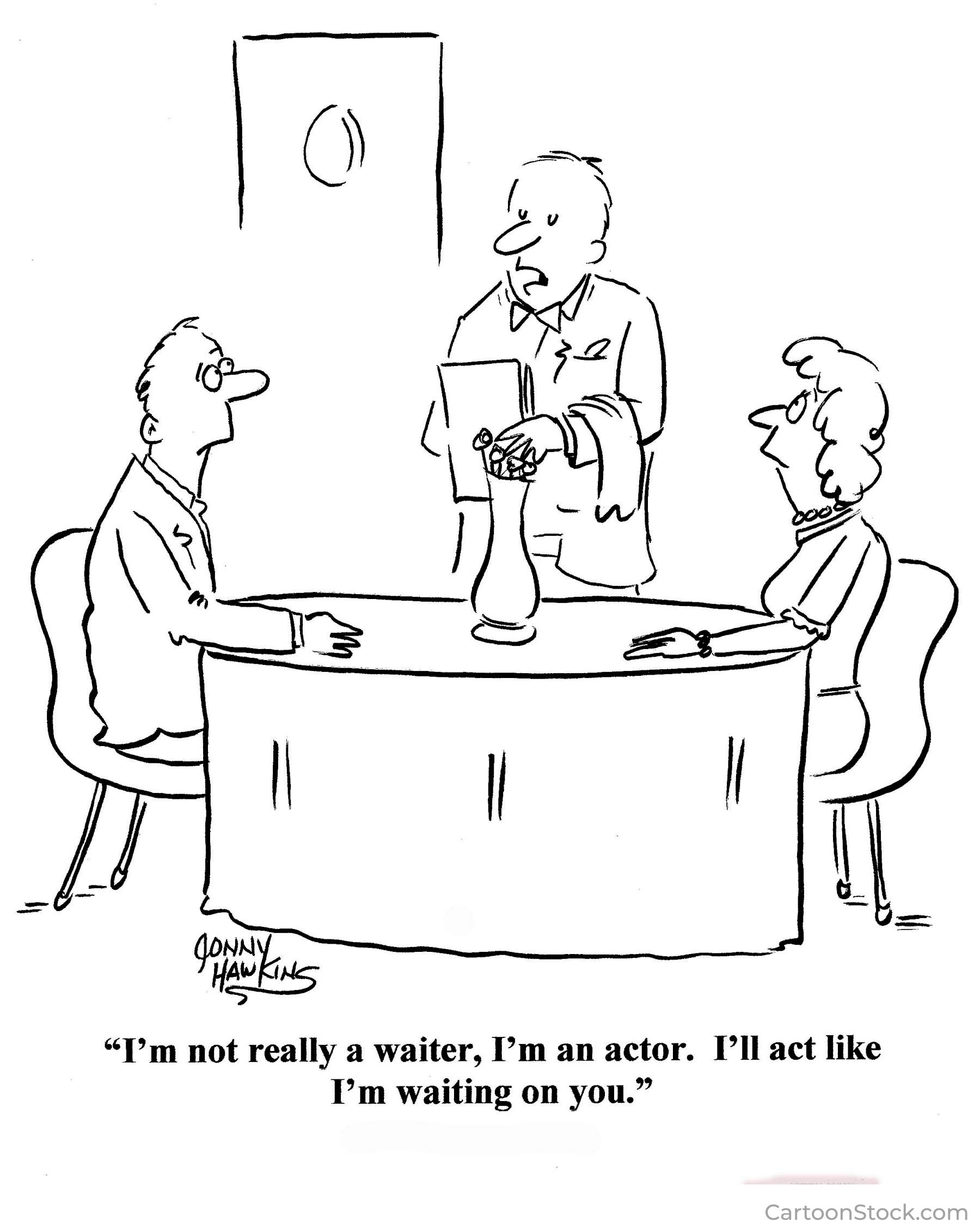

Fourth, students often assume that the rich and famous “success stories” they hear about are typical of what they will make if they choose that career. What percentage of drama school graduates end up as movie stars? Many more are likely to end up like the gentleman in the cartoon.

We are not saying that you should never borrow to finance education. There are many times when this option makes sense. It is helpful to think of education has having two very different components: consumption (rooting for the college team), making friends (including possible spouses), late-night beer parties and some pretty fascinating courses (like “16th Century Religious Movements”). The second part is investment in learning skills (including how to figure out new stuff by going to the library) that will benefit your career. Just like we would never encourage you to borrow money to buy a ticket to the World Cup (consumption), we would be all in favor of your borrowing money to buy machinery to produce your newly-invented electronically guided football (investment). Like any other form of debt, student loan debt requires repayment of principal plus interest and fees. A variety of student loan programs exist. Investigate them carefully to decide what’s best for you. You can get a great education at lower-cost schools that don’t bundle their actual education with consumption items like gourmet dining halls and rock-climbing walls. As an example, graduates of the University of Chicago and the University of California, San Diego have precisely the same earnings, but those who are currently going to Chicago are paying $62,200 a year (less any scholarships)., while those who are going to San Diego pay $16,050 a year unless they come from another state, in which case they pay $48,600 a year. Over a 4-year college career this means the San Diego student pays $54,000 LESS if they come from out of state or a whopping $185,000 LESS if they are a California resident and yet earn the same educational outcome.(158)

To further minimize education risks, students and their parents can pursue other options to finance education. As a general guideline, develop a financial plan that has debt as the last option. Parents, relatives, and friends can start their own savings plans or consider the relative benefits of long-term saving in different forms in financial institutions.

Scholarships and grants are also available. They are particularly attractive because they do not have to be repaid. High school guidance offices and the internet are loaded with scholarship and grant lists. Make time to search for them. Each will have a specific set of instructions, eligibility requirements, and deadlines. Factor all of these options into your decision to invest in education and choose a path that makes sense for you given market considerations.

In addition to education, the purchase of a home is perhaps the most important investment decision each of us will confront during a lifetime. For most, a home purchase will be their largest investment, at least initially. Buying a home you can afford in a desirable location and keeping it well maintained can be a good investment. But there are potential pitfalls. Examination of the following factors will help you avoid the worst problems.

First, carefully consider the “own versus rent” option. Many people immediately conclude that purchasing is a better option than renting, because purchasing can build home equity. They reason that their money is wasted on rent going into the landlord’s pocket when it could be put to work creating equity, helping to build the homeowner’s net worth as the mortgage is paid off and the market value of the property appreciates. However, during the first few years of a mortgage, almost all of the monthly payment is for interest and very little is actually building equity. In most cases, you will accumulate little or no equity during your first three years of ownership. You will simply pay the bank interest instead of paying rent to a landlord.

Second, buying and selling real estate is expensive, and therefore it is not a good idea to purchase a house unless you expect to live in it at least three years. You will need to pay realtor commissions plus VAT levied on commissions, which vary across countries (in Austria, 3 percent; Croatia, 3 percent; Italy, up to 7 percent).(159) Closing costs on a mortgage are typically several thousand dollars. If you sell the house within a few years after the initial purchase, the transaction costs are likely to be greater than your equity.

Third, do not buy a house until you have saved for a down payment. For example, in US if your down payment is less than 20 percent, you will have to pay mortgage insurance, which increases your monthly payment. (Mortgage insurance protects the lender from losses that occur when a person defaults on payments.) It is common in countries including the United Kingdom, Denmark, and Australia. Different countries have different rules about this, so be sure you know what you might have to pay.(160) Also, do not use a mortgage with a low “teaser interest rate” to purchase your home. These rates are followed by sharply escalating interest rates, which will substantially increase your monthly mortgage payment after the initial period has expired. As previously mentioned in Element 4.4, avoid borrowing in a currency different from your income. If the value of your income currency decreases, you could end up owing significantly more money than you initially anticipated.

Fourth, just because you can afford a mortgage payment doesn’t mean you can afford the house. The mortgage is the first and most obvious payment made each month. However, home ownership requires other regular payments and obligations that you need to consider. If they are not included in the mortgage as escrow, property and/or land taxes must be paid. Homeowner’s insurance is required. The roof may leak one day, the hot-water heater, dishwasher, or clothes dryer may break down, the air-conditioning unit or plumbing system may need repair, or any number of other items may result in maintenance costs. You may need a lawn mower and other equipment to maintain your yard. These are all regular expenses you can expect as a homeowner. You need to factor them into your monthly budget when examining whether home ownership makes sense for you.

Lastly, as you build up equity in your house, do not take out another mortgage or borrow against your equity in order to increase your current consumption. Housing prices go down as well as up. After the housing crisis of 2008–2009 in the US, many people were “upside down” or “under water” with their housing. That is, the appraised value of their home was less than the outstanding mortgage. Some people incurred huge losses when they sold their homes. Others simply couldn’t afford to sell at a loss and kept the home, hoping for a market rebound. Still others went through the painful process of foreclosure. Thus, safety dictates that it is important to maintain a sizable equity in your home.

Living by the guidelines presented above will encourage you to live within your means, economize on housing, and minimize the risks involved in housing decisions. Now let’s turn to other potential investments.

While education and housing are likely to be the largest investments you’ll make, other investment opportunities will emerge. There are precautions to take when considering which ones to seize. It is important to recognize that when making investments, you are vulnerable; you must think about whether your interests are aligned with the party offering the investment. Whenever you are offered something that seems to be an extremely attractive proposition, it pays to step back and carefully examine the incentives behind why this proposition is being presented to you. Borrowers looking for money to finance a project will initially turn to low-cost sources such as bank loans. Finding individual investors like you and promising a high rate of return makes no sense if financing is available from bank lenders and other investment specialists. High potential returns on any investment inevitably come with high risk, that is, there is a high probability of failure. If banks and professional investors are not interested in the investment, you should ask yourself, “Why should I be?”

The interests of those selling investment alternatives are often substantially different from yours. While you want to earn an attractive return, they are likely to be primarily interested in the commission on the sale or earnings derived from management fees or a high salary related to the business venture. Put bluntly, their primary interest is served by getting their hands on your money. They do not necessarily seek to defraud you; they may well believe that the investment is a genuine opportunity with substantial earning potential. But, no matter how nice they are, how well you know them, or how much it appears that they want to help you, their interests are different from yours. Moreover, once they have your money, you will be in a weak position to alter the situation.

Today, Bitcoin and other cryptocurrencies are assets that use blockchain technology to facilitate peer-to-peer transactions in a virtual world without borders. Everything is tracked and recorded from inception forward, without fees or requiring financial intermediaries. Data on transaction history and the entities involved in crypto exchanges are difficult to change once recorded, authenticated, and validated in a decentralized public ledger. This makes counterfeiting and double counting cryptos nearly impossible. On the flip side, governments don’t offer market oversight and leave the users of cryptocurrencies to protect themselves from any losses. Plus, their risks are too new to price and insure privately. They are speculative assets. They are relatively new and are not recognized by governments as legal tender. Proceed with caution if you introduce them into your investment portfolio.

How can you tell beforehand whether an investment is a wise one? There is no “silver bullet” that can assure positive results from all investment decisions. But there are things you can do that will help you avoid investment disasters costing you tens of thousands of dollars. The following six guidelines are particularly important.

- If it looks too good to be true, it probably is. This is an old cliché, but a valid one. Some investment marketers may be willing to do just about anything to obtain your money, because once they do, they are in charge and you are vulnerable.

- Deal only with parties that have reputations to protect. Established companies with solid reputations will be reluctant to direct their clients into unsound investments.

- Never purchase an investment solicited by telephone, email, or social media. Such marketing is a technique used by those looking to prey on individuals who are easy targets. Do not let yourself be a victim of scams. Never share personal information with people you do not explicitly trust. Your social security number, credit card number, date of birth, cell phone number, and postal address should be carefully guarded.

- Do not allow yourself to be forced into a quick decision. Take time to develop an investment strategy. Never let yourself be pressured into a hasty decision.

- Do not allow friendship to influence an investment decision. Numerous people have been directed into bad investments by their friends. If you want to keep a person as your friend, invest your money with an objective third party.

- If high-pressure marketing is involved, keep your money and run. Attractive investments are sold without the use of high-pressure marketing techniques. If you already have a substantial portfolio, there may be a place in it for high-risk investments, including “junk” bonds and precious metals. But those investments must come from funds that you can afford to lose. If you are looking for a sound way to build wealth, most of your funds should be in more routine lower-risk investments, helping you establish a well-diversified portfolio.